Given this COVID-19 pandemic that we are all facing right now, providing a complete and inclusive way for Filipinos to transact with the government online through ‘cashless’ ecosystems is CRITICAL. This, as the government accelerates its digital push, an executive from digital financial services PayMaya said recently.

“Everything is going online, including government services, but we have to ensure that every Filipino is able to continue transacting with government and receive much-needed aid through cashless ecosystems that are pervasive and at the same time inclusive,” said Orlando B. Vea, Founder and CEO of PayMaya, during the BusinessWorld Insights Forum which discussed digital payments acceptance for LGUs held on Tuesday.

Vea said this means enabling the government to accept a wide range of payment methods, including credit/debit cards and e-Wallets, complemented by a vast and accessible physical payment center experience that can help bridge the gap for the unbanked and the underserved segment of the population.

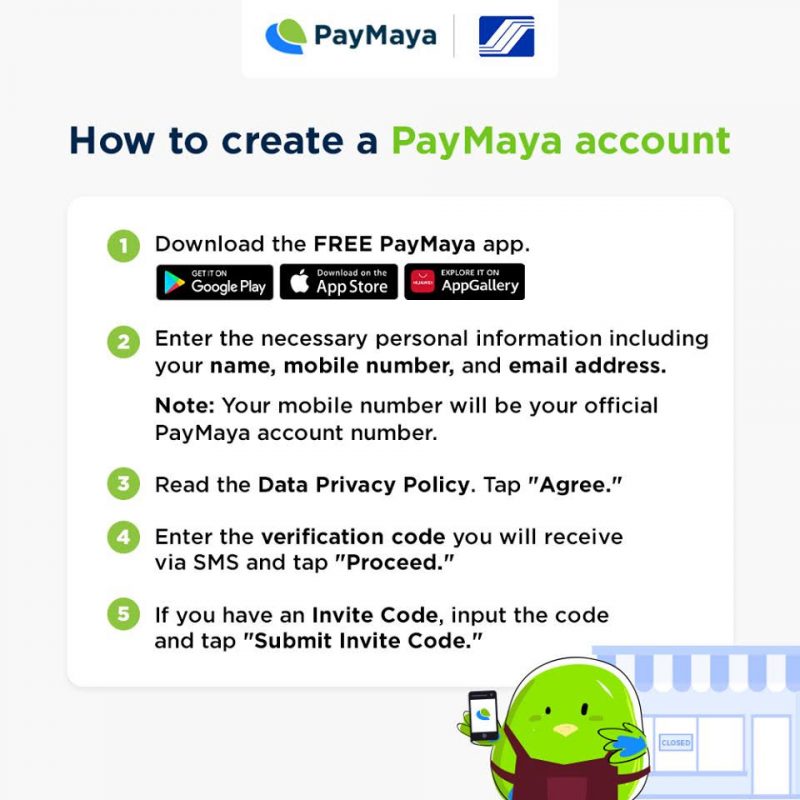

This end-to-end payments ecosystem is what PayMaya provides its partners as it brings the full payment suite–from a consumer e-Wallet app, to a host of solutions for government payment acceptance, and more than 30,000 Smart Padala touchpoints able to process digital financial transactions nationwide.

To date, PayMaya has helped enable more than 50 government agencies, government-owned and controlled corporations, as well as local government units in their respective bids to digitize their processes and bring a more efficient and transparent government service to the people. It has also disbursed more than P1.4 billion in financial aid on behalf of its national and local government partners as part of their respective financial aid programs in response to the current COVID-19 crisis.

Just recently, PayMaya signed a partnership with the Bureau of Customs to enable the agency with digital payments acceptance as it prioritizes online transactions for safer and more transparent delivery of services, as well as the Department of Foreign Affairs to allow them to accept credit/debit card and e-Wallet payments for passport application and renewal appointments.

Other government partners of PayMaya include the Bureau of Internal Revenue, the Social Security System, PAG-IBIG Fund, Department of Trade and Industry, Department of Foreign Affairs, Department of Science and Technology, as well as the Professional Regulation Commission, among many others.

On the local level, the cities of Caloocan, Las Piñas, Manila, Mandaluyong, Pasig, and Quezon City have also utilized PayMaya to deliver financial aid to senior citizens, persons with disabilities (PWDs), solo parents, and scholars, among other constituents in their respective localities.

The BusinessWorld Insights Forum with the theme “Enabling LGUs in the New Normal through Digital Payments Acceptance” is presented by PayMaya and the USAID E-PESO program, in cooperation with the Department of the Interior and Local Government, the Anti-Red tape Authority, the Union of Local Authorities of the Philippines, and the Management Association of the Philippines.

Related Images:

Mindanaoan is a multi-awarded blogger, content creator, seasoned social media strategist and publicist with undeniably successful track record. 2012 International Visitor Leadership Program (for global leaders) alumnus and O visa grantee (for people with extraordinary skills and who have risen to the top of their field). Avid traveler and a proud relief operations volunteer. Regular resource person for social media, blogging and content creation. Available for work and travel – mindanaoan@gmail.com