Digital financial services leader PayMaya is leading the charge toward financial inclusion as it expands its footprint to reach over 200,000 touchpoints nationwide, the largest network in the country to date.

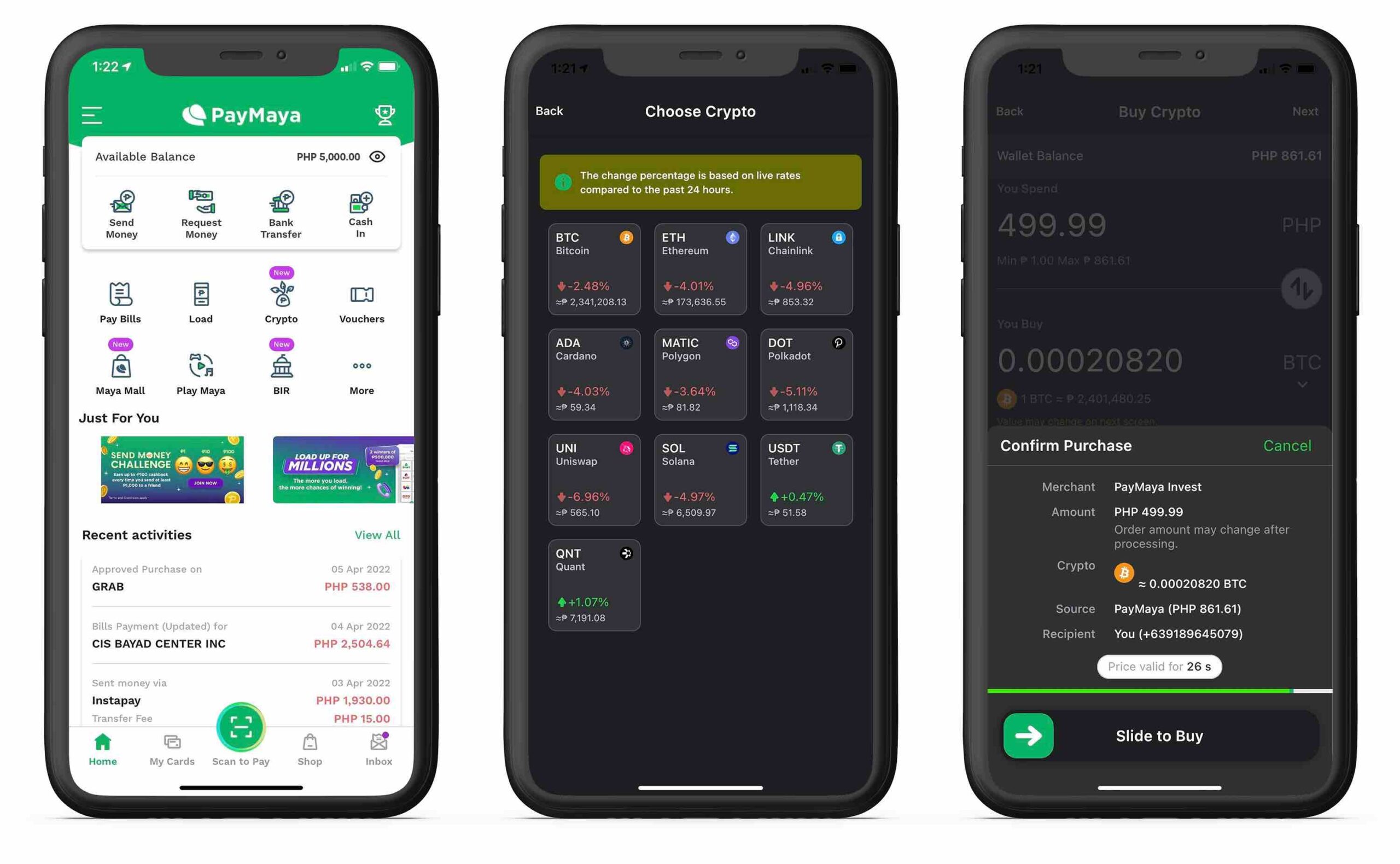

Filipinos can easily pay, add money, cash out, or remit using their PayMaya accounts through these accessible touchpoints that include convenience stores, retail merchants, groceries, department stores, food outlets, pawnshops, and Smart Padala centers, among others.

“As PayMaya continues to lead the push towards cashless for all Filipinos, it is important for us to provide them with the most expansive and reliable on-ground channels that allow them to do safe and convenient financial transactions, no matter where they are in the country,” said Shailesh Baidwan, President of PayMaya.

“We have built this robust ecosystem of touchpoints to help ensure that there are easily available and trusted avenues for our customers to add, transact, or move money for all their day-to-day needs,” he added.

Unrivaled network of trusted touchpoints

PayMaya account holders need not travel very far to city centers as PayMaya’s unrivaled on-ground network of over 37,000 Smart Padala partner agent touchpoints serves as last-mile financial hubs, enabling lifeline transactions amid COVID-19 quarantine restrictions.

PayMaya’s unrivaled network of on-ground and digital touchpoints is six times larger than the combined 12,371 bank branches and 22,162 ATM terminals currently operating across the country.

Smart Padala agents are present even in the farthest reaches of the country, covering over 92% of all cities and municipalities nationwide. In a country where banking presence is limited to only 69% of all cities and municipalities, Smart Padala agents are connecting unbanked and underserved Filipinos to the digital economy, offering remittance, bills payment, add money, cash out, and scan-to-pay transactions.

PayMaya also taps into its network of trusted enterprise merchants, including MSMEs using its PayMaya Negosyo app for payment acceptance.

PayMaya’s vast ecosystem of merchants, payment centers, and financial agents have become critical particularly in the government’s push to provide financial aid to those severely affected by the COVID-19 pandemic and various natural disasters in the past year.

By sending financial aid to their PayMaya accounts, beneficiaries can easily use the funds in PayMaya QR partner merchants or encash via the nearest Smart Padala centers in their area, making it faster and more convenient for them to get their everyday essentials.

“PayMaya has become a lifeline to many people during the pandemic, and we’re seeing it become even more essential for consumers, businesses, and the government in the years to come,” Baidwan explained.

Related Images:

Mindanaoan is a multi-awarded blogger, content creator, seasoned social media strategist and publicist with undeniably successful track record. 2012 International Visitor Leadership Program (for global leaders) alumnus and O visa grantee (for people with extraordinary skills and who have risen to the top of their field). Avid traveler and a proud relief operations volunteer. Regular resource person for social media, blogging and content creation. Available for work and travel – [email protected]